40 what is zero coupon bonds

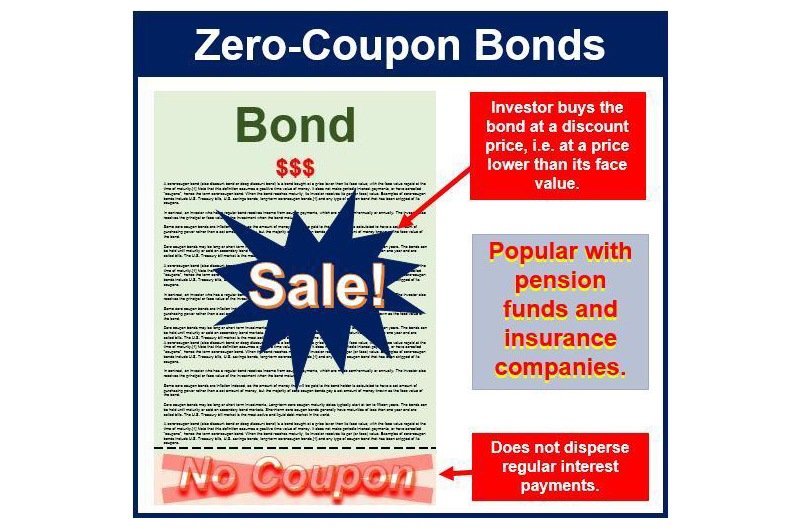

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

What is zero coupon bonds

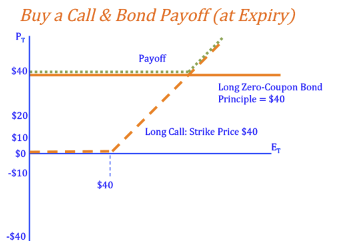

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What is zero coupon bonds. Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds. Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

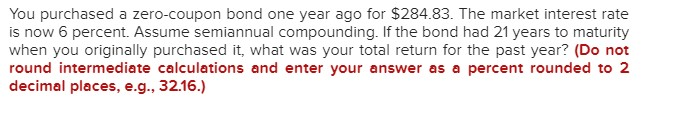

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Zero Coupon Bond Question : CFA - reddit.com For which the correct answer is : A) A zero coupon bond may sell at a premium to par when interest rates decline. B) All interest is earned at maturity. C) The lower the price, the greater the return for a given maturity. The thought that went through my mind is: It is possible for a zero coupon bonds to sell at a premium if there is a negative ... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds are meant for those investors who want to avoid market risk involved in the share market. Zero Coupon Bonds assures a fixed maturity amount after a certain period. Therefore, the investors who have want to get a fixed return in future with less market risk should go for these bonds.

What Is a Zero-Coupon Bond? | The Motley Fool Also known as accrual bonds, zero-coupon bonds are debt securities that are sold at a deep discount for a price far below their face value. The reason? Unlike traditional bonds, zero-coupon bonds...

For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

What is a Zero-Coupon Bond? - Realonomics Under what situation can a zero coupon bond be selling at par to its face value? What is the role of a zero coupon bond in a structured product? Are treasury STRIPS a good investment?

SEBI declares Zero coupon, zero principal bond as securities The Central Government has declared "zero coupon zero principal instruments" as securities for the purposes of the Securities Contracts (Regulation) Act, 1956. Note: "zero coupon zero principal instrument" means an instrument issued by a Not for Profit Organisation which shall be registered with Social Stock Exchange segment of a ...

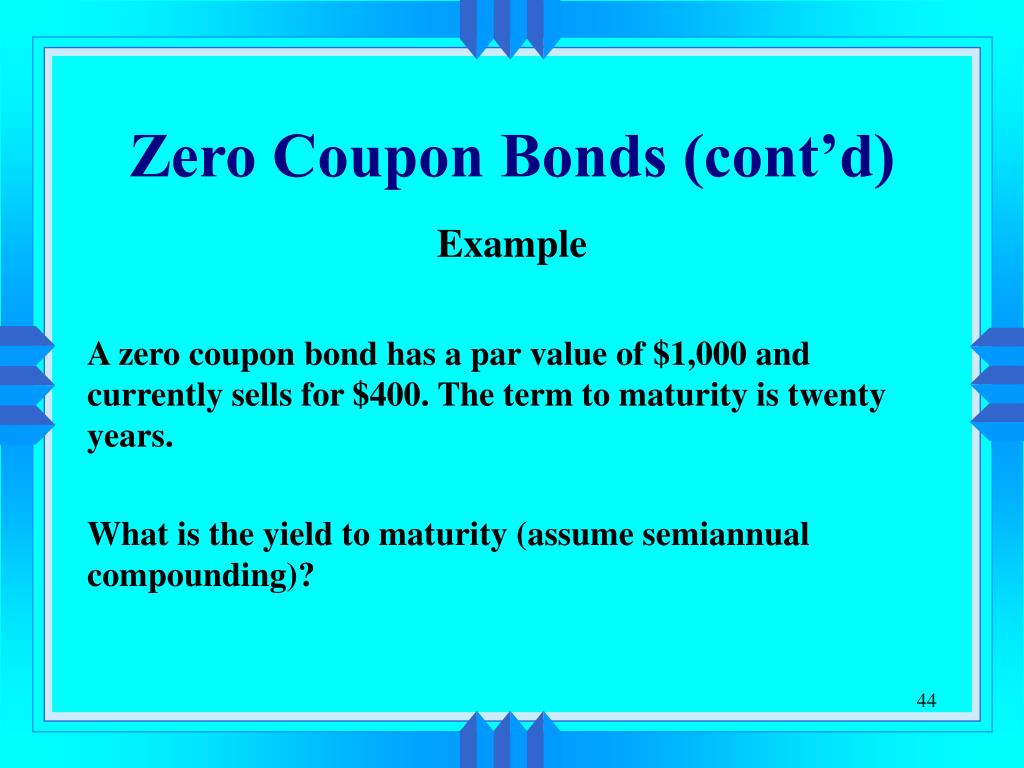

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero coupon, zero principal bond declared securities-Business Journal The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

Post a Comment for "40 what is zero coupon bonds"