38 present value of zero coupon bond calculator

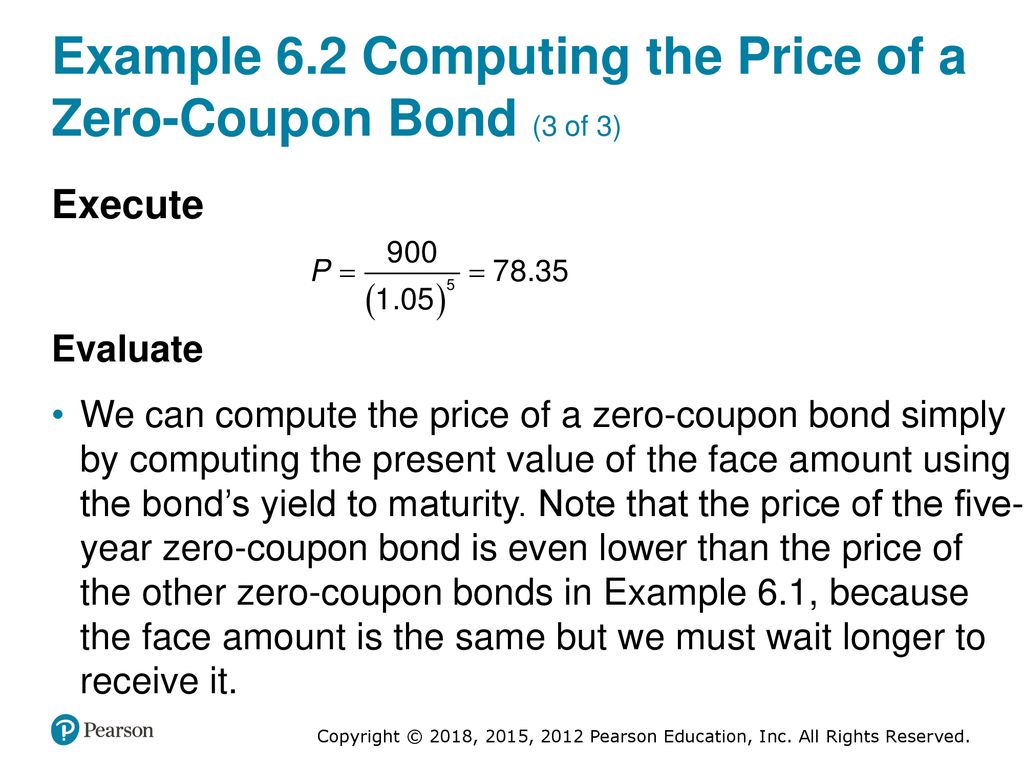

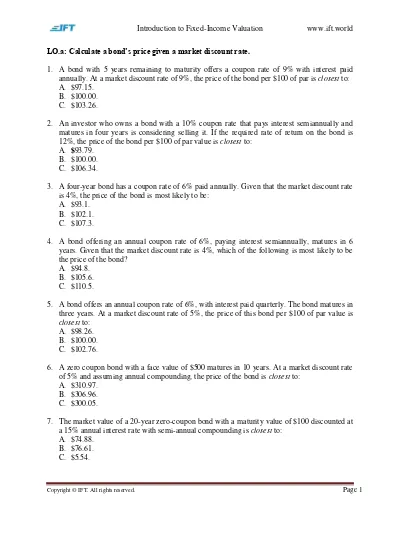

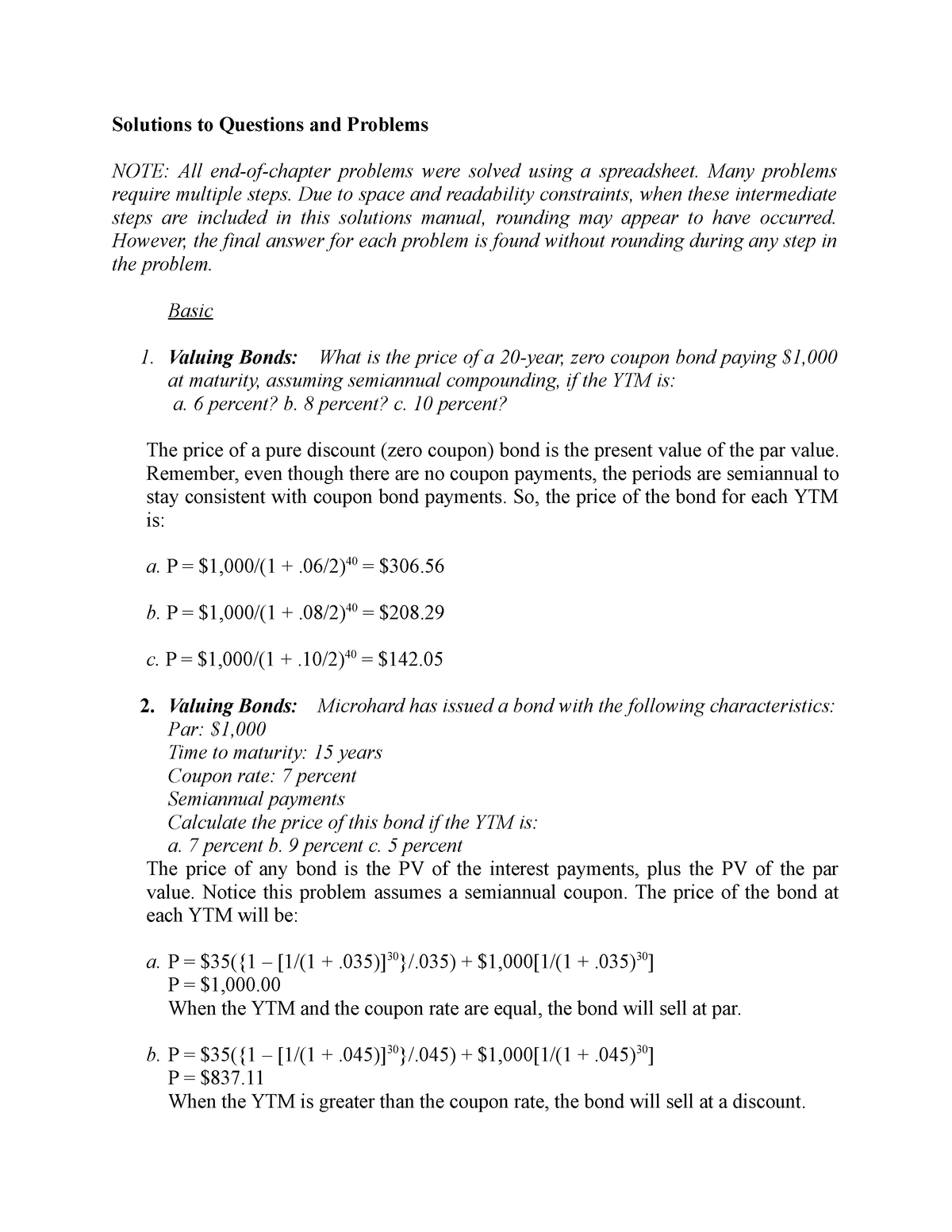

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) We can calculate the Present value by using the below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example: How To Calculate Zero Coupon Bond On Financial Calculator Zero coupon bond value = 1000 / (1 + 6) ^ 5. A zero coupon bond which has a face value of rs.1000 is issued at the rate of 6%. After solving the equation, the original price or value would be $74.73. Thus the present value of zero coupon bond with a yield to maturity of 8% and maturing in 10 years is $463.19.

4 Basic Things to Know About Bonds - Investopedia 24.10.2022 · Basic Bond Characteristics . A bond is simply a loan taken out by a company. Instead of going to a bank, the company gets the money from investors who buy its bonds. In exchange for the capital ...

Present value of zero coupon bond calculator

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ... Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. Solved Calculate the Present Value of a zero-coupon bond | Chegg.com Expert Answer. Part 1 Face value = 1,000,000 Maturity n = 10 years Interest rate r = 6% or 0.06 Now present value of zero coupon bond is Present value = Face value …. View the full answer.

Present value of zero coupon bond calculator. What are Zero-Coupon Bonds? (Characteristics + Calculator) To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity Stock Quotes, Business News and Data from Stock Markets | MSN … 28.11.2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ... Bond Present Value Calculator See Present Value Concepts - Calculating the Present Value of a Bond and Present Value of a Bond Formula for discussions on computing the present value of bonds. Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator Zero Coupon ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Present Value Calculator Zero Coupon Bond - bizimkonak.com Zero Coupon Bond Value - Formula (with Calculator) - finance … CODES (9 days ago) Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t … Visit URL. Category: coupon codes Show All Coupons The Power of Compound Interest: Calculations and Examples 19.7.2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ... NBA News, Expert Analysis, Rumors, Live Updates, and more Get breaking NBA Basketball News, our in-depth expert analysis, latest rumors and follow your favorite sports, leagues and teams with our live updates.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Calculator - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon Zero Coupon Bond Calculator – What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Bond Definition: What Are Bonds? – Forbes Advisor 24.8.2021 · Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the bond’s maturity date (3% of $1,000 par value = $30 per annum). Yield: The ...

Bond Price Calculator - Present Value of Future Cashflows - DQYDJ Anyway, this is what we are using for 'the time between payments' internally to the bond pricing calculator: ONE YEAR = 360 Days TWICE A YEAR = 180 Days ONCE A QUARTER = 90 Days ONCE A MONTH = 30 Days NONE = At Maturity (Zero Coupon Bonds) The accrued interest formula is: F * (r/ (PY)) * (E/TP) Where: F = Face value of the bond r = Coupon rate

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity

Bond Yield Calculator Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg See Answer. 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity.

Zero Coupon Bond Value Calculator | StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator How do you value a zero-coupon bond? The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Zero Coupon Bond Yield Calculator - Find Formula, Example & more The yield of the bond will be. The formula is: Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1. The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1. Here, the bond will provide the investor with a yield of 7.39%.

Solved Calculate the Present Value of a zero-coupon bond | Chegg.com Expert Answer. Part 1 Face value = 1,000,000 Maturity n = 10 years Interest rate r = 6% or 0.06 Now present value of zero coupon bond is Present value = Face value …. View the full answer.

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10.

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

Post a Comment for "38 present value of zero coupon bond calculator"