41 coupon rate bond calculator

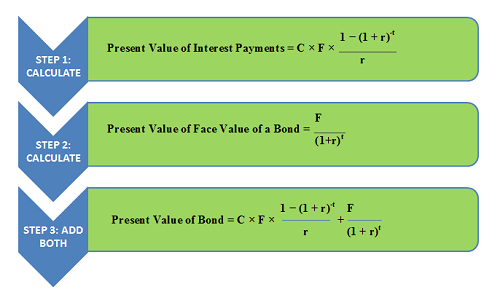

› calculator › bond-valuationBond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button. › loanLoan Calculator Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime. Loan Basics for Borrowers

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon rate bond calculator

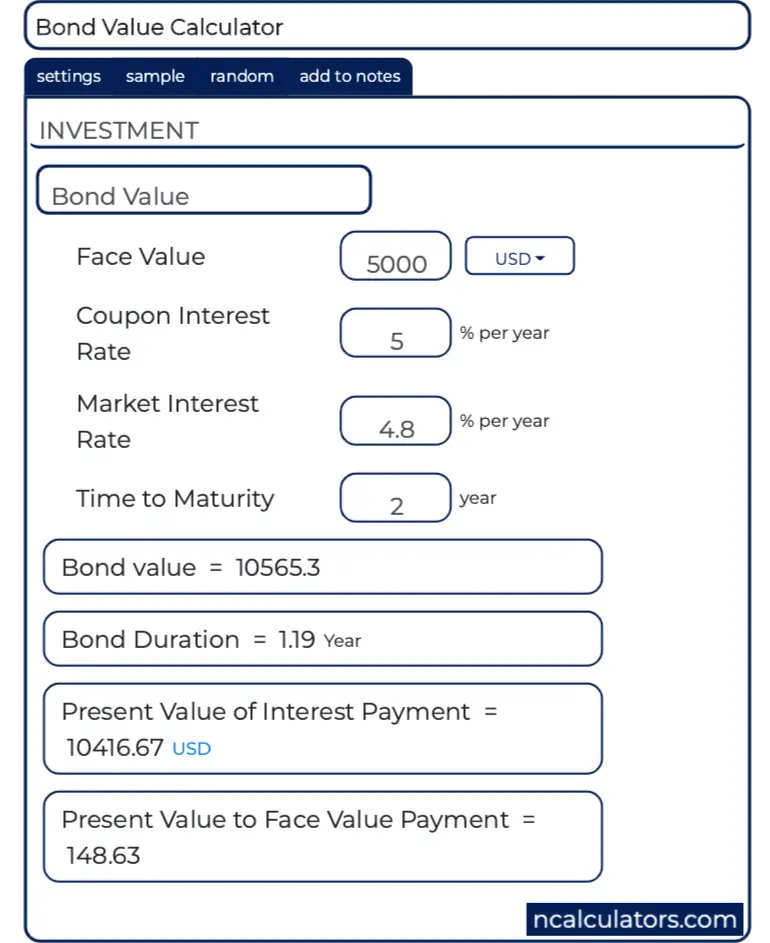

Coupon Rate Definition - Investopedia 28/05/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ... Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the coupon rate of the bond (only numeric characters 0-9 and a decimal point, no percent sign). The coupon rate is the annual interest the bond pays. If a bond with a par value of $1,000 is paying you $80 per year, then the coupon rate would be 8% (80 ÷ 1000 = .08, or 8%).

Coupon rate bond calculator. What Is a Bond Coupon? - The Balance 04/03/2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... What Is the Coupon Rate of a Bond? - The Balance 18/11/2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. nerdcounter.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. In our example ...

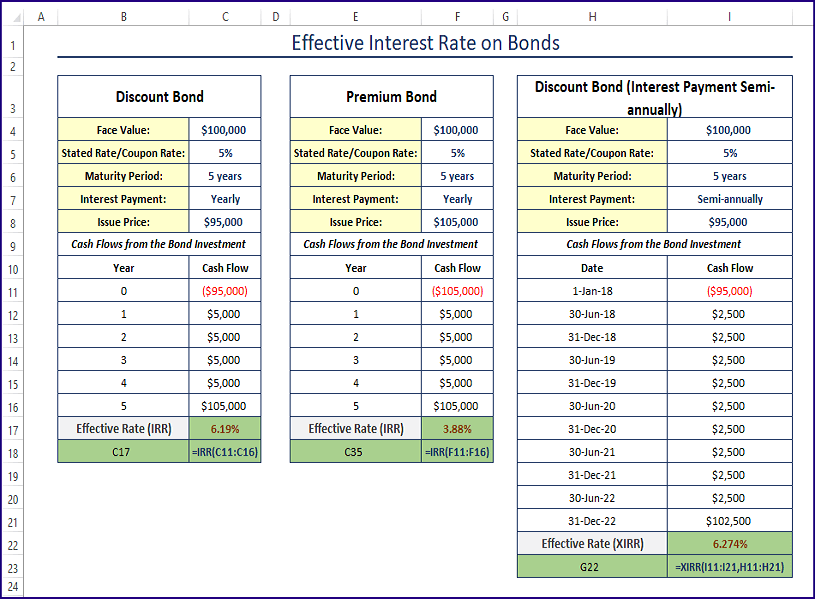

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi ... Coupon Rate Calculator | Bond Coupon 15/07/2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to … en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR). Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs. Bond Face Value/Par Value ($) - The face or par value of the bond – essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.; Months to Maturity - The numbers of months until bond …

Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Zero Coupon Bond Calculator - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that’s why it is necessary to divide the rate by two, to have the semi-annual payment. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the coupon rate of the bond (only numeric characters 0-9 and a decimal point, no percent sign). The coupon rate is the annual interest the bond pays. If a bond with a par value of $1,000 is paying you $80 per year, then the coupon rate would be 8% (80 ÷ 1000 = .08, or 8%).

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Coupon Rate Definition - Investopedia 28/05/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "41 coupon rate bond calculator"