40 what is the coupon rate of a bond

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. [Solved] A bond that matures in 10 years has a 1000 par value The ... A bond that matures in 10 years has a $1,000 par value. The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 15 percent. What would be the value of this bond if it paid interest annually?

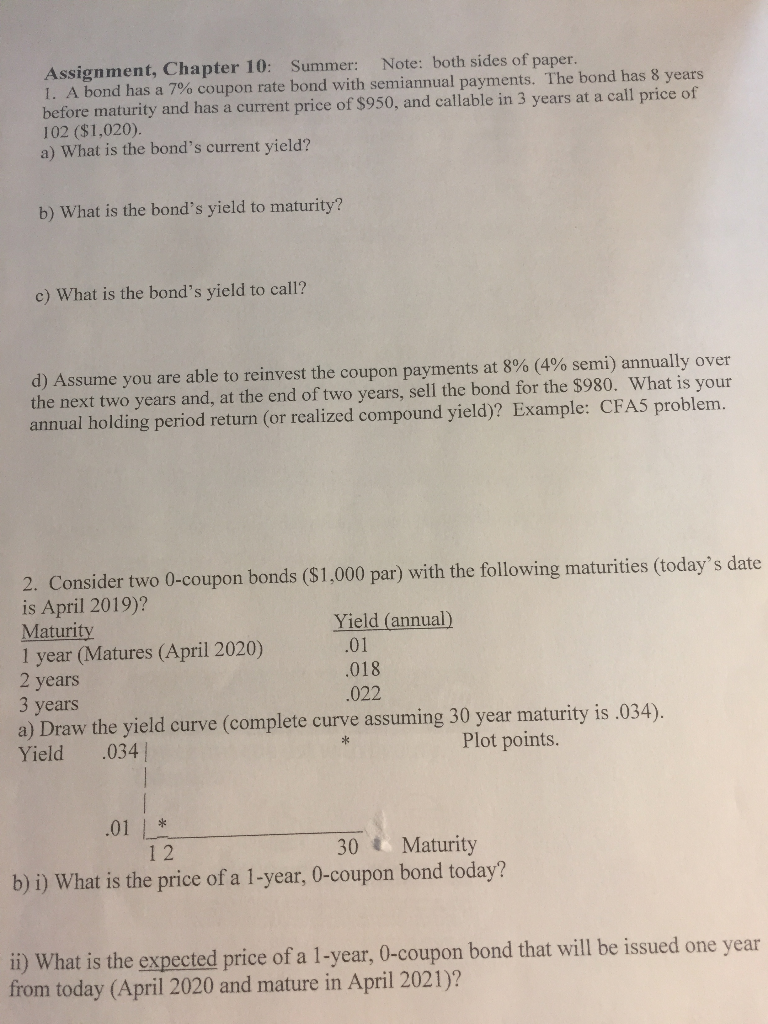

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is the coupon rate of a bond

What Is a Coupon Rate? - Investment Firms A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

What is the coupon rate of a bond. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of … Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Solved What is the bond coupon rate on a \( \$ 25,000 \) | Chegg.com The bond coupon rate is Question : What is the bond coupon rate on a \( \$ 25,000 \) mortgage bond that has semiannual interest payments of \( \$ 1250 \) and a 20 -year maturity date? (Express your answer as a percentage with no decimals.)

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ... Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

Coupon Bond: Definition, How They Work, Example, and Use Today Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

What Is the Coupon Rate of a Bond? | SoFi A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ...

Answered: What is the coupon rate for a bond with… | bartleby What is the coupon rate for a bond with 3 years until maturity, a price of $1,053.46, and a yield to maturity of 7%? Interest is paid annually.

What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

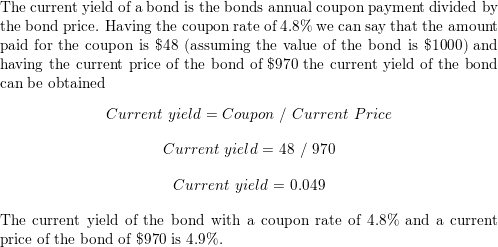

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ...

What Is a Coupon Rate? - Investment Firms A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each ...

Post a Comment for "40 what is the coupon rate of a bond"