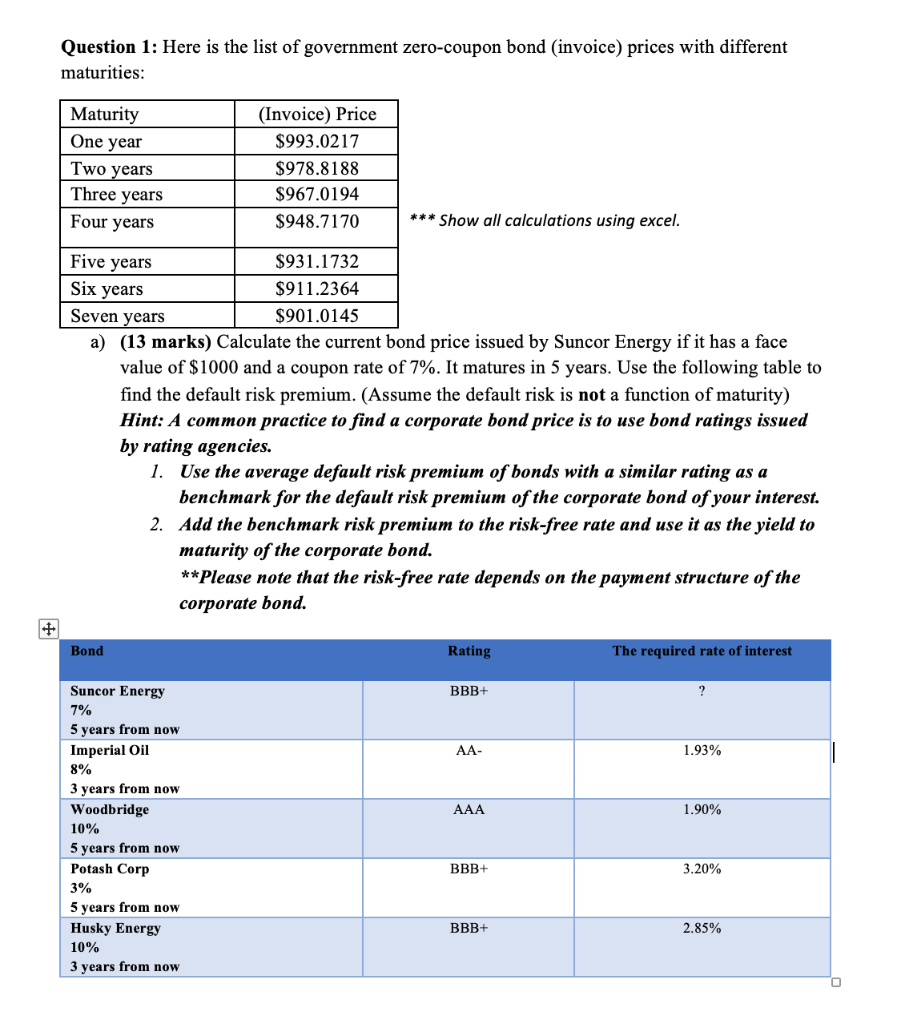

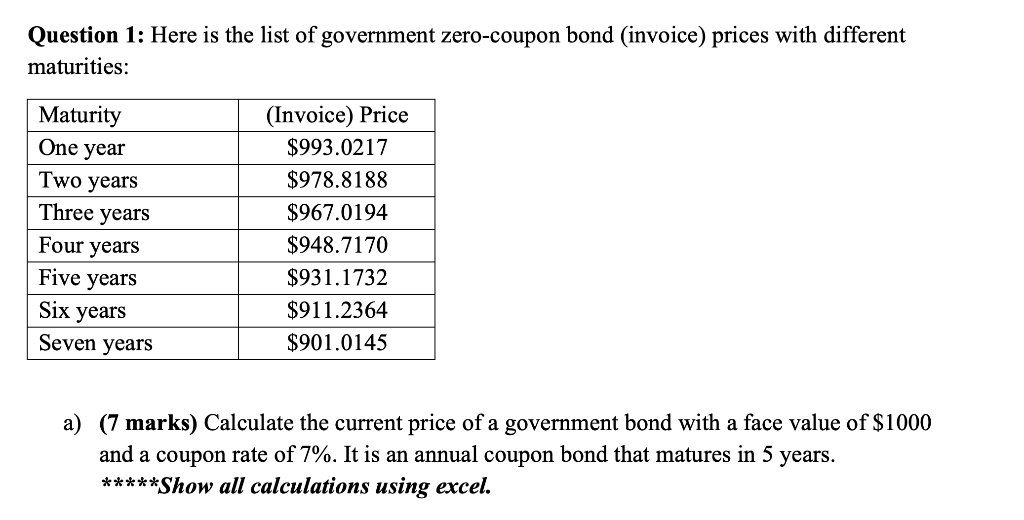

45 government zero coupon bonds

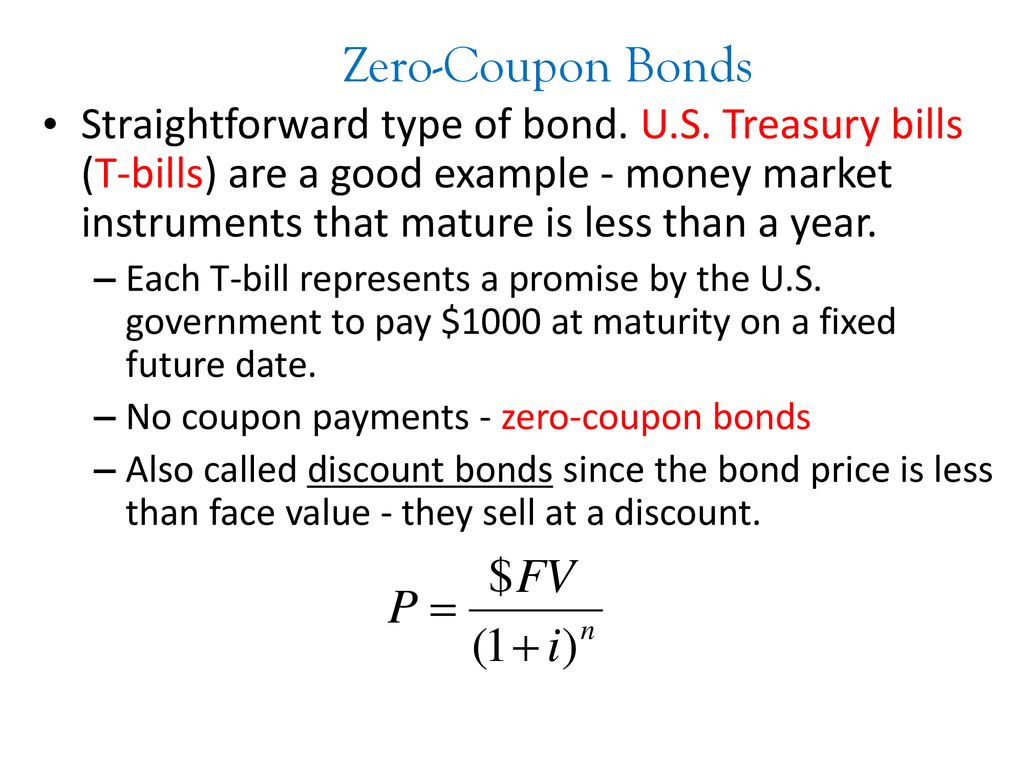

How to Invest in Zero-Coupon Bonds - US News & World Report Zeros are purchased through a broker with access to the bond markets, or with an actively managed mutual fund or and index-style product like an exchange-traded fund. PIMCO 25+ Year Zero Coupon US... Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000.

Reserve Bank of India Most Government bonds in India are issued as fixed rate bonds. For example - 8.24%GS2018 was issued on April 22, 2008 for a tenor of 10 years maturing on April 22, 2018. ... of 182 Day T-Bills plus a fixed spread decided by way of auction. Zero Coupon Bonds - Zero coupon bonds are bonds with no coupon payments. However, like T- Bills, they ...

Government zero coupon bonds

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 3 days ago, on 30 Sep 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Government zero coupon bonds. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ... How Do I Buy Zero Coupon Bonds? | Budgeting Money - The Nest Buy municipal zero coupon bonds from the state or city where you live to avoid paying federal income tax on the phantom interest. Municipal bonds are issued by the state, county or other local government. You can also avoid paying tax on the interest by buying corporate zero coupon bonds that have tax-exempt status. Zero Coupon Yield Curve - The Thai Bond Market Association 1. The above yields are based upon average bids quoted by primary dealers, after 15% data cut-off from top and bottom when ranked by value. 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.775% yield. 10 Years vs 2 Years bond spread is -39.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

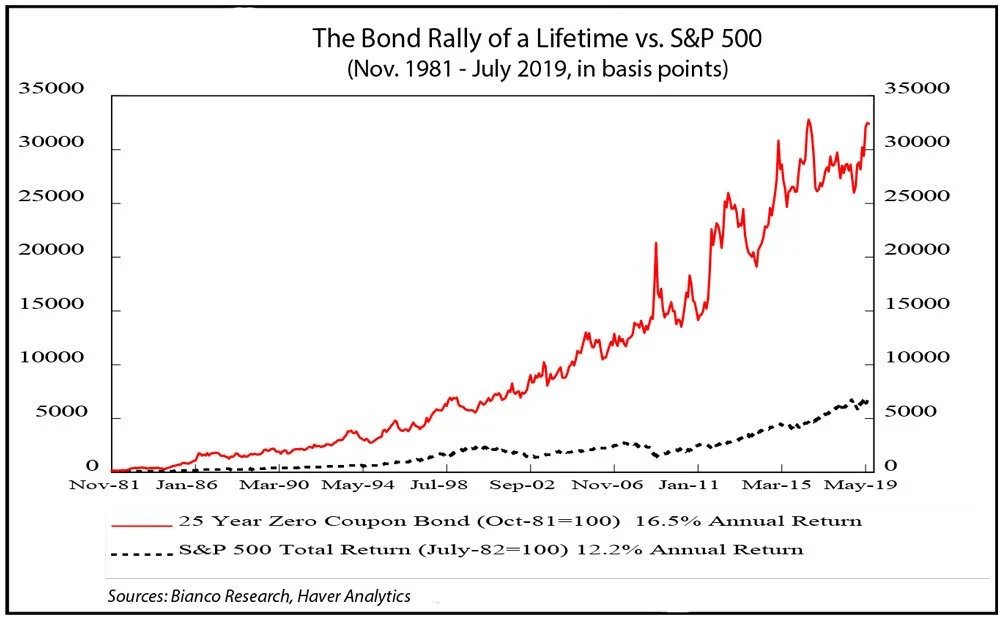

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds come in many varieties. They may be issued by federal, state, and local governments or by corporations. Perhaps the most familiar zero-coupon bonds for many investors are the old... What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a... Government - Continued Treasury Zero Coupon Spot Rates* Government › Interest Rates and Prices ... IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. Prompt Payment Act Interest Rate. Monthly Interest Rate Certification. Quarterly Interest Rate Certification. ... (Zero Coupon) Rates" on the following website: ... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Under Income Tax Act, 1961, Income derived from gain on sale of shares, debentures, bonds etc. attracts taxability under the head of "Capital Gains". Such gain is either taxable as short term capital gain or long term capital gain. In this article, we will discuss the concept of "Zero Coupon Bonds" and throw light on taxing aspects of ...

Are government bonds zero coupon? - savbo.iliensale.com A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. are an example of a zero-coupon bond. How are US government bonds quoted? Bonds are generally quoted as percentage of face value ($1,000). ZERO COUPON GOVERNMENT BONDS - The Economic Times Public sector banks to get ₹15,000 crore via zero-coupon bonds in FY22 This comes even as some banks had reached out to the government seeking clarity given that the Reserve Bank of India has asked them to account for these bonds at fair value. 23 Feb, 2022, 01.35 PM IST RBI orders five banks to list zero coupon bonds at "fair value" US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ... Moved Permanently. The document has moved here.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Government, Zero-Coupon & Floating-Rate Bonds - Study.com Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.234% yield. 10 Years vs 2 Years bond spread is 9.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

savingsbond.gov Moved Permanently. The document has moved here.

What are Zero Coupon Bonds? - Civilsdaily Prelims level : Zero-Coupon Bonds Mains level : Banks recapitalization measures The government has used financial innovation to recapitalize a bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds called Zero-Coupon Bonds. Try this PYQ:

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 3 days ago, on 30 Sep 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/14-Figure3-1.png)

/GettyImages-597139701-d3b44a08d65844a89c458a6ed9950100.jpg)

Post a Comment for "45 government zero coupon bonds"