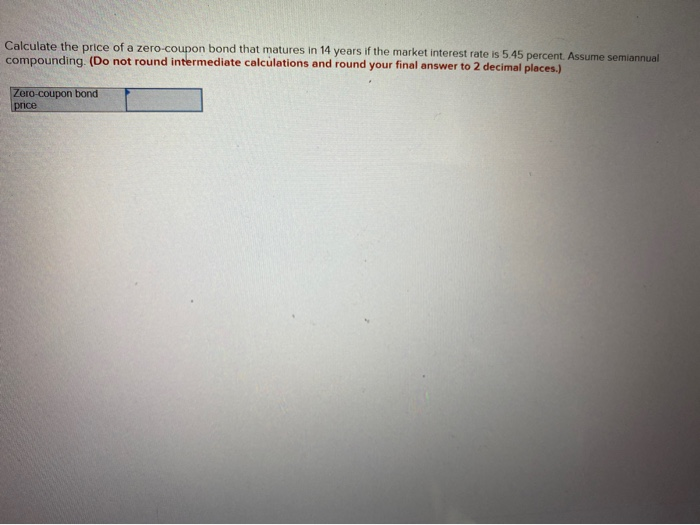

43 calculate zero coupon bond price

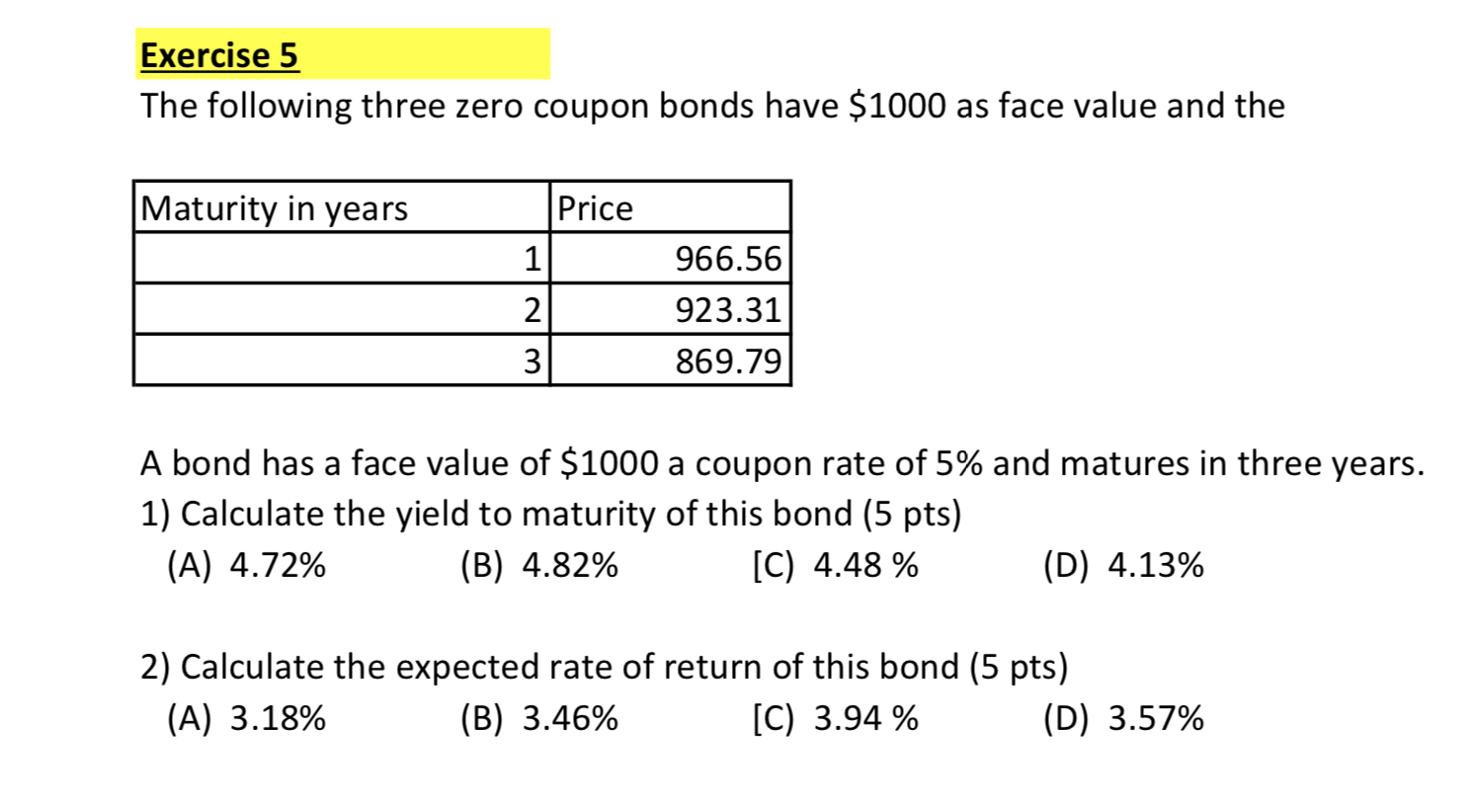

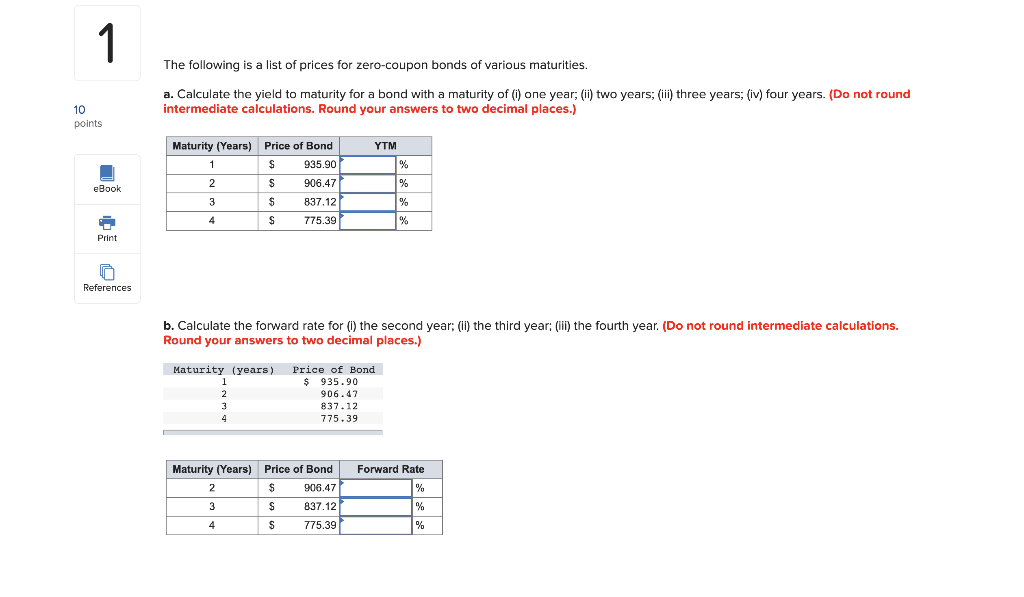

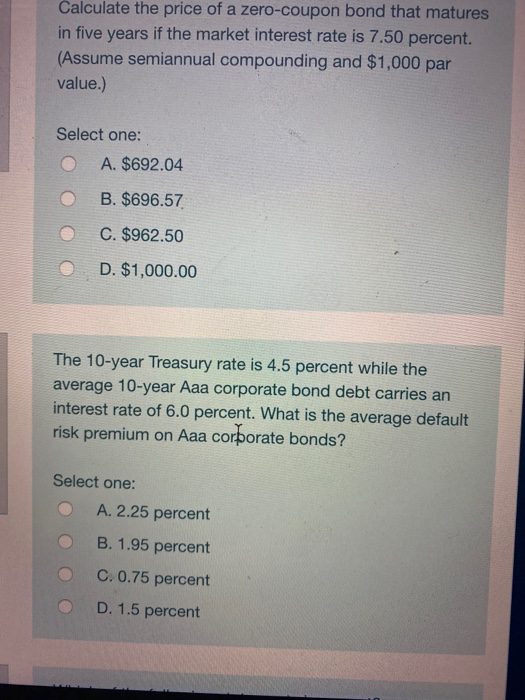

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Calculate Price of Bond using Spot Rates | CFA Level 1 Sep 27, 2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

Bond Discount - Investopedia 29/05/2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

Calculate zero coupon bond price

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ... Bond Yield Calculator - CalculateStuff.com To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. The bond pays out $21 every six months, so this means that the bond pays out $42 every year. The current market price of the bond is how much the bond is worth in the current market place. You just bought the bond, so we can assume ...

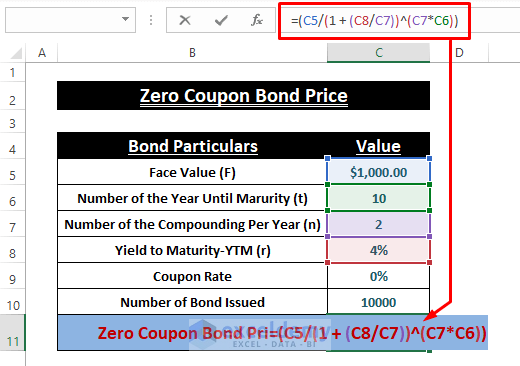

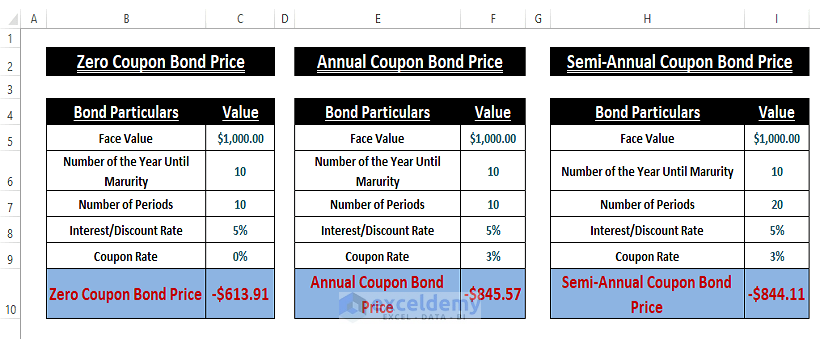

Calculate zero coupon bond price. The Basics Of Bonds - Investopedia 31/07/2022 · Bonds are generally priced at a face value (also called par) of $1,000 per bond, but once the bond hits the open market, the asking price can be priced lower than the face value, called a discount ... How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot … How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · A. Zero Coupon Bonds Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ... Bond Formula | How to Calculate a Bond | Examples with Excel … On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, ... Calculate the price of each bond and the money that can be raised by ASD Inc. through these bonds if the YTM based on current market trends is 5%. Solution: Bond Price is calculated using the formula given below. Bond Price = F / (1 +r / n) n*t. Bond Price = $1,000 / …

Bond Yield Calculator - CalculateStuff.com To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. The bond pays out $21 every six months, so this means that the bond pays out $42 every year. The current market price of the bond is how much the bond is worth in the current market place. You just bought the bond, so we can assume ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ... Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 calculate zero coupon bond price"