38 t bill coupon rate

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box. AT&T Internet + AT&T Deals | Broadband Plans & Offers Price for internet 300 for new residential customers & is after $5/mo autopay & paperless bill discount. Pricing for first 12 months only. After 12 mos., then prevailing rate applies. $5/mo discount: Must enroll in autopay & paperless bill at point of sale or within 30 days of service activation to receive discount. Must maintain autopay ...

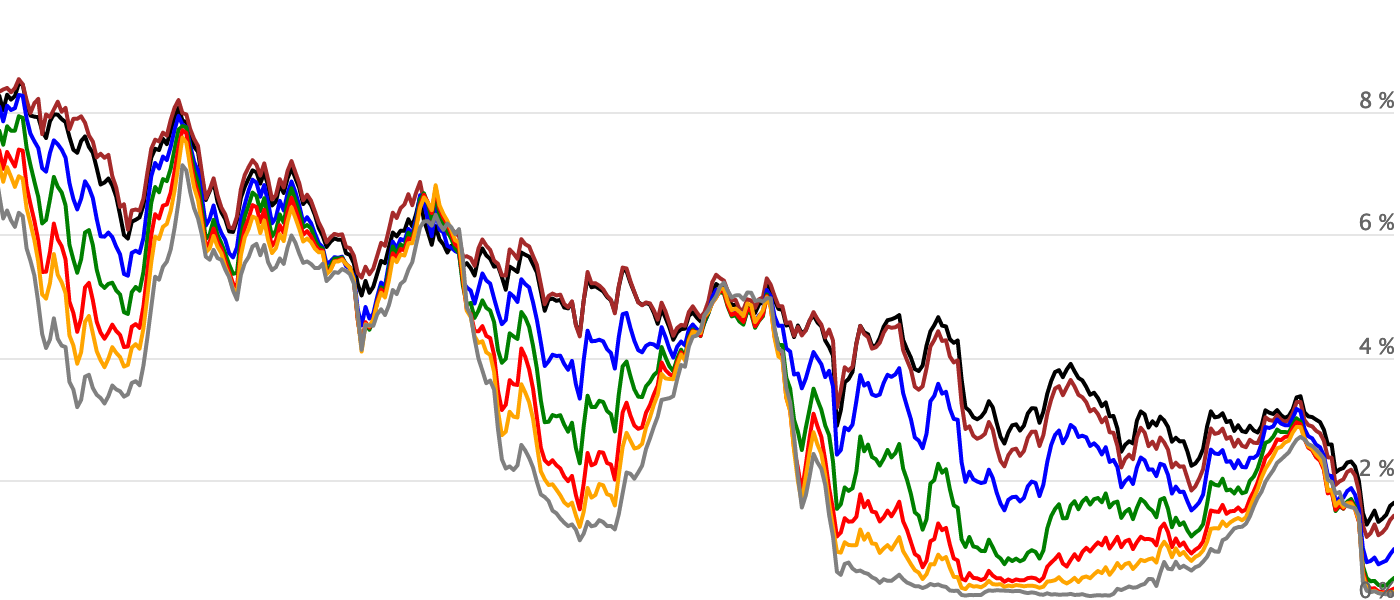

United States Interest Rates: T-bill - 3 months - Secondary market ... Interest Rates: T-bill - 3 months - Secondary market; discount basis for United States from U.S. Board of Governors of the Federal Reserve System (FRB) for the H.15 Selected Interest Rates [D, W, M] release. This page provides forecast and historical data, charts, statistics, news and updates for United States Interest Rates: T-bill - 3 months - Secondary market; discount basis.

T bill coupon rate

US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment, The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button, How To Read A T-Bill Quote - Investopedia The bidprice represents the interest ratethe buyer wants to be paid for the bond. Converting the bid into an actual price requires a bit of work. 4*100/360=$1.11, $10,000-$1.11=$9,998.89, In this... The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2022 The average rate of inflation over that period was 3.02%, which means a real return (return adjusted for inflation) of 0.3%. T Bills are sold at a discount and don't pay a coupon like most bonds, so they simply return their face value at maturity. The difference between your purchase price and that face value is your "interest.",

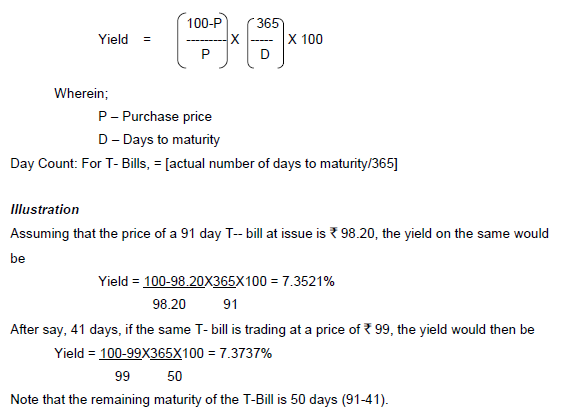

T bill coupon rate. Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... T-bills: Information for Individuals - Monetary Authority of Singapore What It Is Good For. Use T-bills to: Diversify your investment portfolio. Receive a fixed interest payment at maturity. Invest in a safe, short-term investment option. The price of SGS T-bills may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds ... M&T Bank Promotions: Top 4 Offers for September 2022 Oct 07, 2022 · What to Open at M&T Bank. 12-month or 24-month CD. M&T offers a great rate for their Select Promo CDs of 12-month or 24-month term. The minimum to open is $1,000. This opening deposit cannot be money already on deposit at M&T Bank. EZChoice Checking. This is M&T's free checking option. It has no monthly service fee or minimum balance requirements. Your Money: How rate of return on T-Bills is calculated A bill with more than 182 days to maturity, would be compared with a bond with more than 182 days to maturity, which is not a zero coupon security. Thus, the bill must be treated as if it too pays ...

Personal Finance: Short-Term T-Bill Interest Rates Are Way Up - Bloomberg The shortest-term T-bill lasts just a month and is offering a rate of 2.6%, according to Bloomberg data. Three-month bills are paying 3.2% and one-year bills a generous 4.1%. It was 0.04% on a... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 3.21: 3.28% +50 +329: 10:22 PM: Reserve Bank of India - Frequently Asked Questions The variable coupon rate for payment of interest on this FRB 2024 was decided to be the average rate rounded off up to two decimal places, of the implicit yields at the cut-off prices of the last three auctions of 182 day T- Bills, held before the date of notification. ... (WAY) of last 3 auctions (from the rate fixing day) of 182 Day T-Bills ... T-Mobile & Sprint merged to create America's 5G leader in ... Savings with T-Mobile 3rd line free via mo. bill credits vs. comparable available plans; plan features and taxes & fees may vary. Credits stop if you cancel any lines. Qualifying new account & credit req'd.

What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes. Daily SGS Prices - Monetary Authority of Singapore Treasury Bills: Bonds : 6-Mth: 1-Year: 2-Year: 5-Year: 10-Year: 15-Year: 20-Year: 30-Year: 50-Year: Issue Code Coupon Rate Maturity Date BS22119T 04 Apr 2023 BY22102V 25 Jul 2023 ... Issue Code Coupon Rate Maturity Date BS22119T 04 Apr 2023 BY22102V 25 Jul 2023 NY09100H 3.000% 01 Sep 2024 N522100N 2.875% 01 Sep 2027 NX22100W 2.625% 01 Aug 2032 Treasury Bills | Constant Maturity Index Rate Yield Bonds ... - Bankrate Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers. Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security.

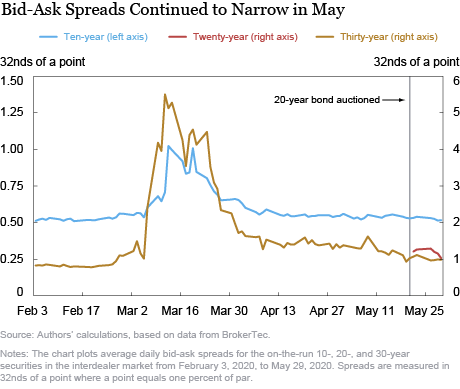

Treasuries - WSJ Treasury Notes & Bonds. Treasury Bills. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields ...

13 Week Treasury Bill (^IRX) Historical Data - Yahoo Finance Get historical data for the 13 Week Treasury Bill (^IRX) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions.

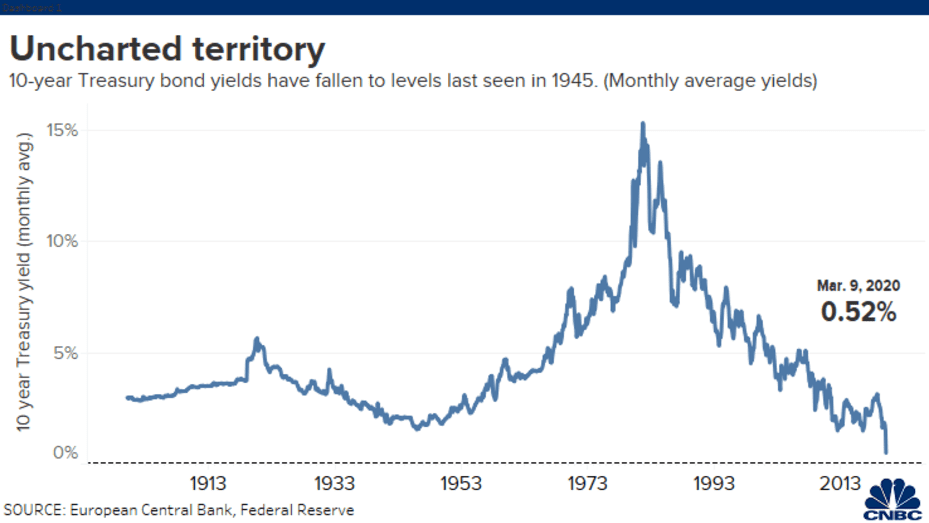

6 Month Treasury Bill Rate - YCharts The 6 month treasury yield reached nearly 16% in 1981, as the Fed was raising its benchmark rates in an effort to curb inflation. 6 Month Treasury Bill Rate is at 3.78%, compared to 3.78% the previous market day and 0.05% last year. This is lower than the long term average of 4.48%. Report. H.15 Selected Interest Rates. Category. Interest Rates.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

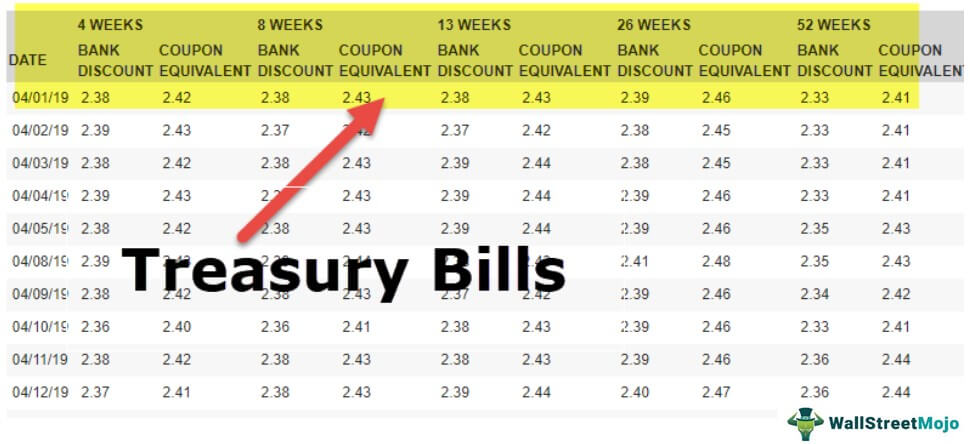

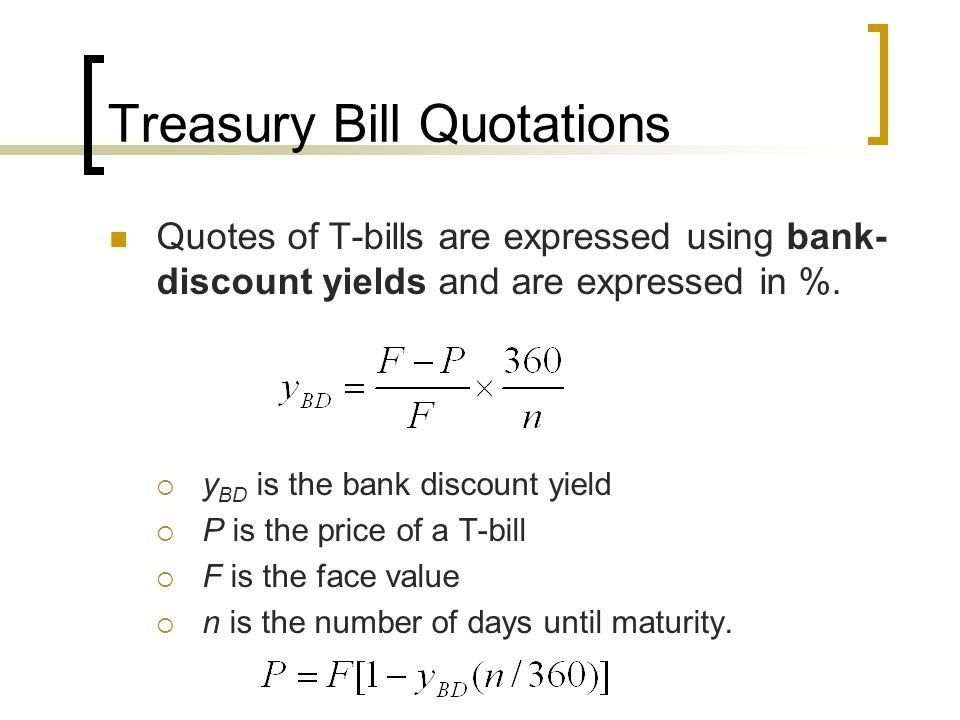

Price, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

Solved The annual coupon rate for an inverse floater is (10% | Chegg.com The annual coupon rate for an inverse floater is (10% - T-bill rate) and coupon payments are made annually. The face value of the bond is $1,000,000. Assume that the current T-bill rate for the specific period is 4%. What would be the coupon payment for the inverse floater in this period? Group of answer choices, None, $40,000, $70,000, $60.000,

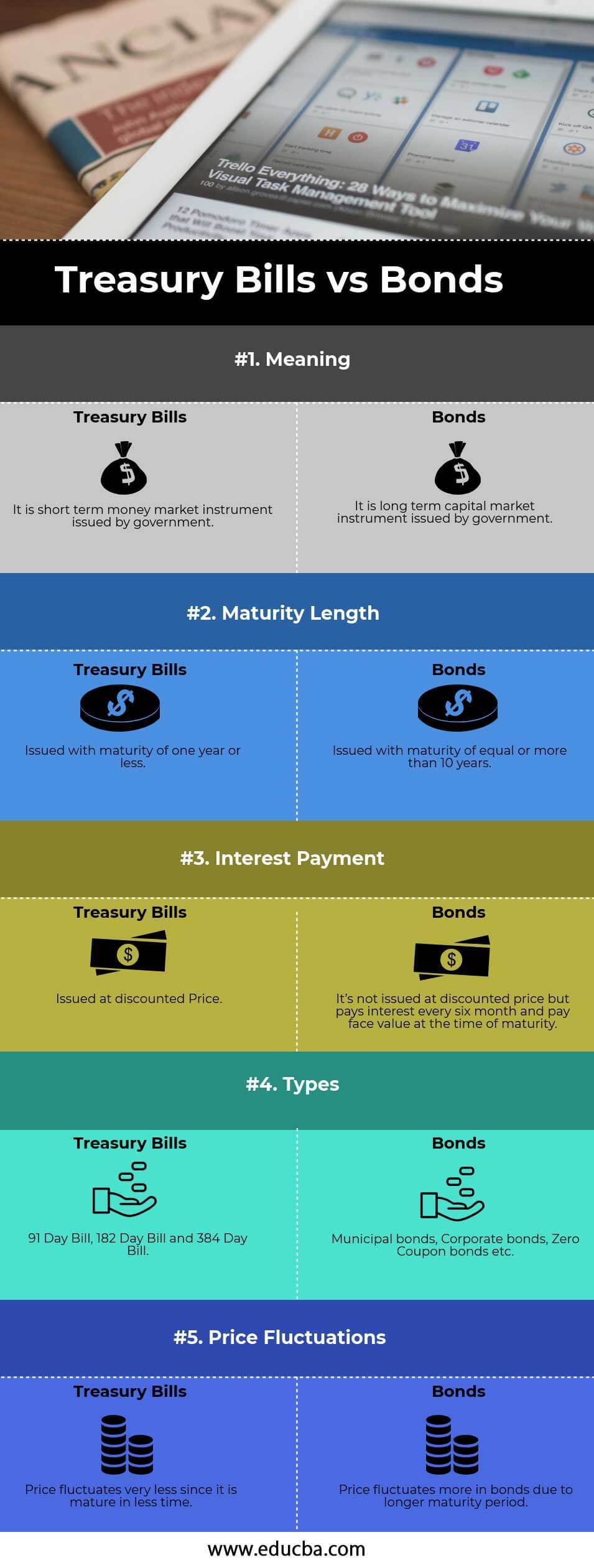

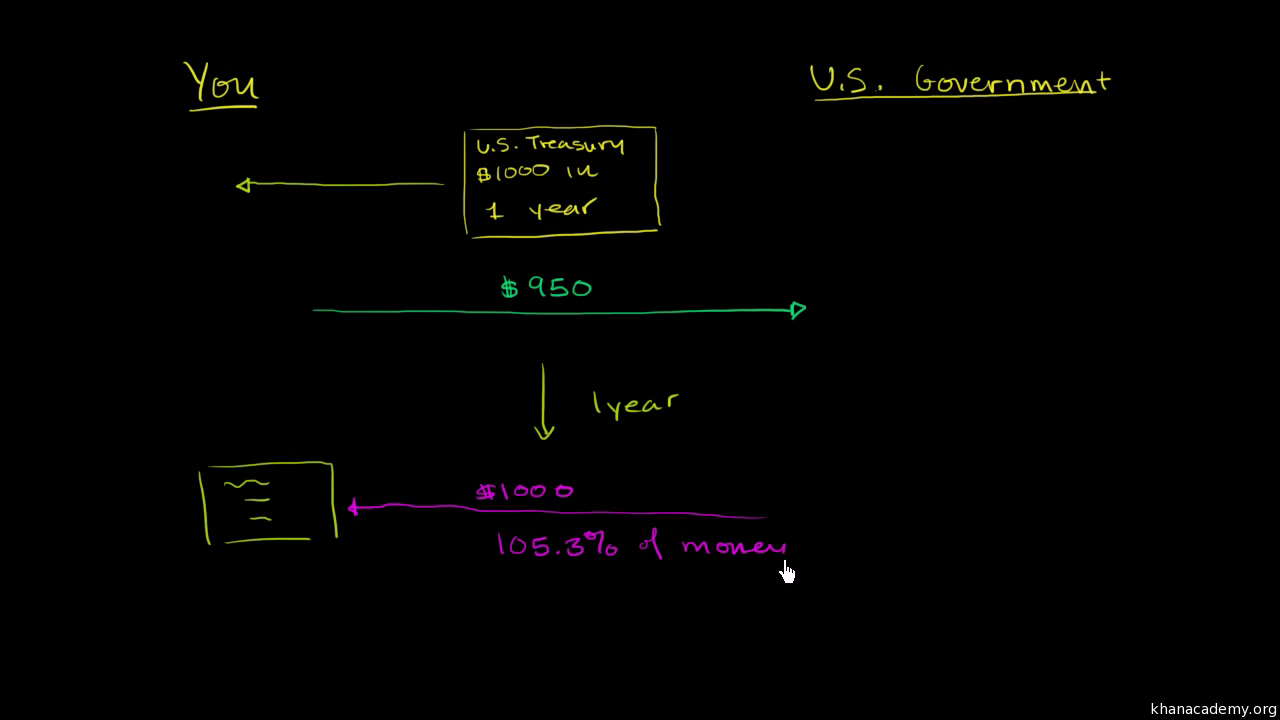

Individual - Treasury Bills: Rates & Terms Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98. You would pay $98 for the bill at purchase and you would get $100 when the bill matures.

The Basics of the T-Bill - Investopedia Jan 30, 2022 · T-Bills can be purchased in increments of $100 (in maturity value). They resemble zero-coupon bonds in that they are issued at a discount and mature at par value, with the difference between the ...

91 Day T Bill Treasury Rate - Bankrate 91-day T-bill auction avg disc rate, 91-day T-bill auction avg disc rate, What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly...

Chili's Coupons and Coupon Codes for September, 2022 Bill Grammenos: 01/25/2019 On January 23,2019, we celebrated our grandchild’s birthday. I ordered my drinks which was hot tea,everyone received there drinks, I waited and waited, I had to go ask for my hot tea.

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia The T-Bill pays no coupon—interest payments—leading up to its maturity. T-bills can inhibit cash flow for investors who require steady income. T-bills have interest rate risk, so, their rate could...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Open 4.147%, Day Range 3.930 - 4.157, 52 Week Range -0.376 - 4.215, Price 3 30/32, Change 0/32, Change Percent -0.06%, Coupon Rate 0.000%, Maturity Sep 7, 2023, Performance, Change in Basis Points,...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

How To Invest In Treasury Bills - Forbes Advisor Since they offer such short maturities, T-Bills don't offer interest payment coupons. Instead, they're called "zero-coupon bonds," meaning that they're sold at a discount and the difference between...

Treasury Bills - Guide to Understanding How T-Bills Work For example, a $1,000 T-bill may be sold for $970 for a three-month T-bill, $950 for a six-month T-bill, and $900 for a twelve-month T-bill. Investors demand a higher rate of return to compensate them for tying up their money for a longer period of time. Risk Tolerance, An investor's risk tolerance levels also affect the price of a T-bill.

India Treasury Bills (over 31 days) | Moody's Analytics - economy.com Treasury bills or T-bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day. Treasury bills are zero coupon securities and pay no interest. ... The cut-off yield is taken as the coupon rate for the security ...

The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2022 The average rate of inflation over that period was 3.02%, which means a real return (return adjusted for inflation) of 0.3%. T Bills are sold at a discount and don't pay a coupon like most bonds, so they simply return their face value at maturity. The difference between your purchase price and that face value is your "interest.",

How To Read A T-Bill Quote - Investopedia The bidprice represents the interest ratethe buyer wants to be paid for the bond. Converting the bid into an actual price requires a bit of work. 4*100/360=$1.11, $10,000-$1.11=$9,998.89, In this...

US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment, The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button,

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/982/982ed877-b22d-4a05-b201-776ff4989f4a/phpimKzm7.png)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "38 t bill coupon rate"