41 relationship between coupon rate and ytm

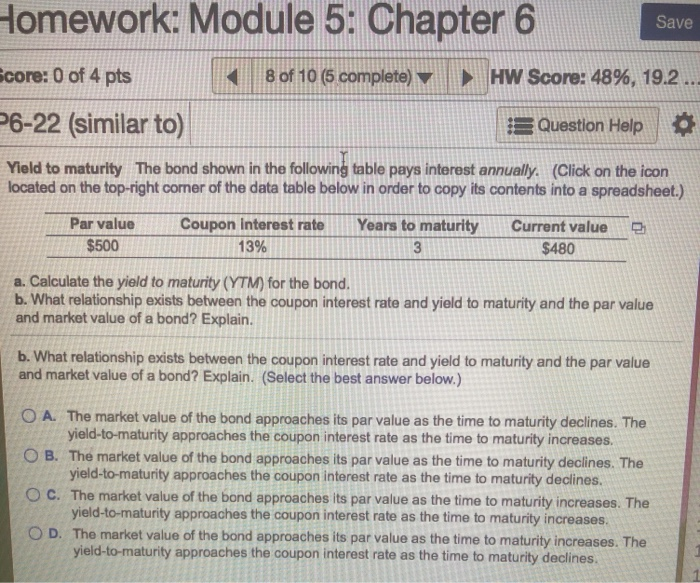

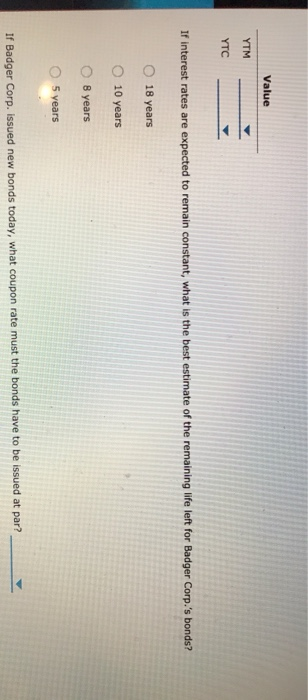

Current Yield - Relationship Between Yield To Maturity and Coupon Rate ... a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. Current Yield = Total Yield - Capital Gains Yield. The current yield is the annual payment divided by the price. Algebraically expressed as Y = R/P, where Y is yield, R is the annual payment, and P represents price. This creation shows the fine line between ... Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel. solve what you enter. The 4% value is the 6-month interest rate. YTM is an annual rate.

What relationship between a bond's coupon rate and a bond's yield would ... Coupon rate: it is the interest rate applicable on the face value. e.g. Rs. 1,000 bond ten year bond with a coupon rate of 8% will give Rs. 80 (8% of Rs. 1,000) every year for a period of 10 years and on maturity, you will get the principal amount of Rs. 1,000. How is this different from a fixed deposit?

Relationship between coupon rate and ytm

Yield to Maturity vs. Yield to Call: The Difference - Investopedia Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value - Purchase price/years until... achieverpapers.comAchiever Papers - We help students improve their academic ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Relationship between coupon rate and ytm. coursehelponline.comCourse Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. What is the relationship between coupon rate required yield and price ... When is the yield to maturity equals the coupon rate? When a Bond's Yield to Maturity Equals Its Coupon Rate. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. Nov 18 2019 Bond Coupon Interest Rate: How It Affects Price - Investopedia The Inverse Relationship Between Interest Rates and Bond Prices. Fixed Income. When is a bond's coupon rate and yield to maturity the same? Bonds. How the Face Value of a Bond Differs From Its Price. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

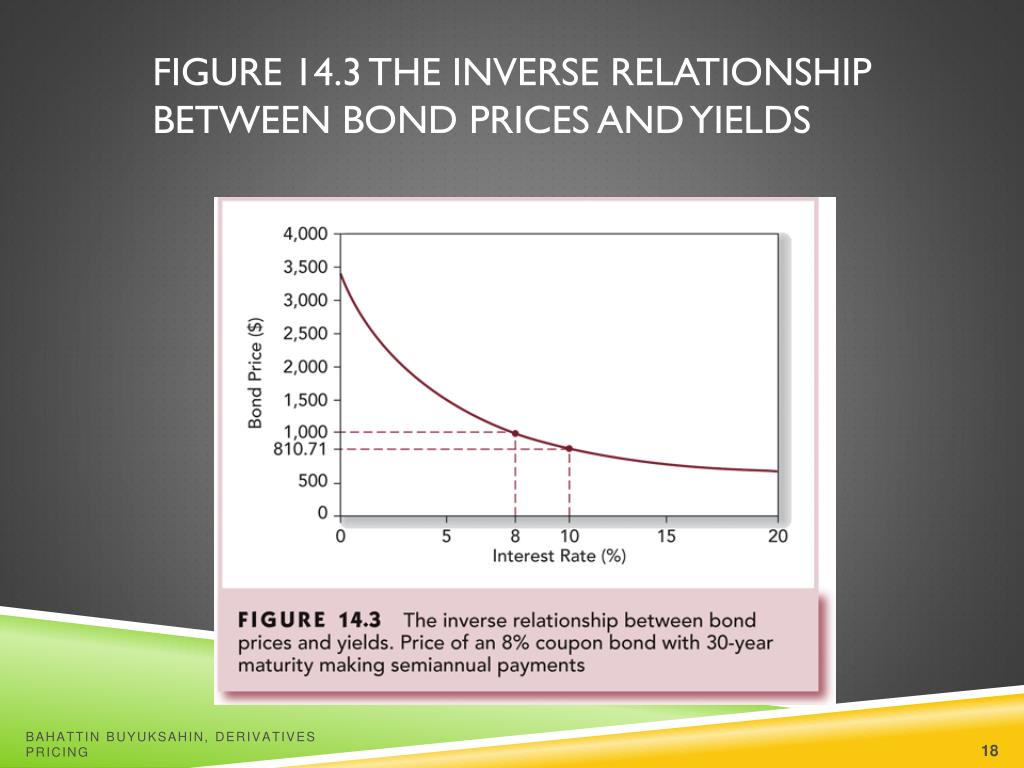

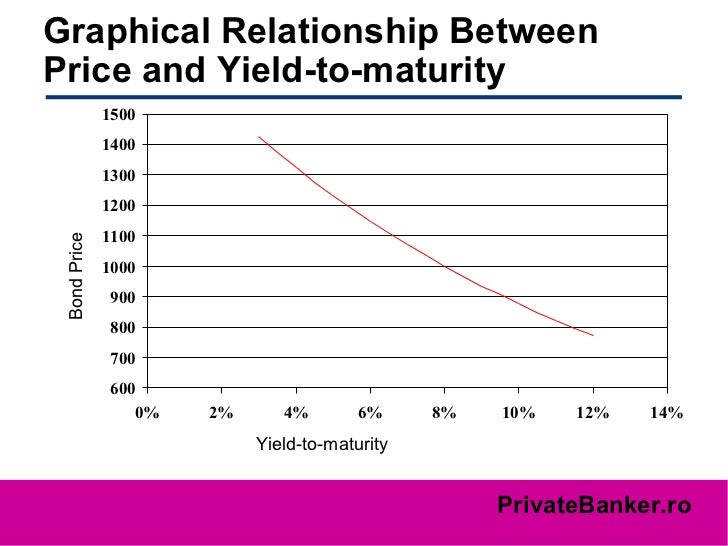

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A bond's yield to maturity rises or falls depending on its market value and how many payments remain to be made. The Relationship Between a Bond's Price & Yield to Maturity However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100. If you paid more than $1,000 for the bond, your yield to maturity would be less than 6 percent, as you would get back less than you paid at maturity. 00:00 00:00. Relationship Between Coupon Interest Rate And Ytm Set in Bandung, which is approximately 2 hours drive from Jakarta and features a comfortably cooler climate than relationship between coupon interest rate and ytm most Indonesian cities, the Hilton Bandung hotel is only a short drive to the many dining and entertainment options at nearby Paris Van Java. Puerto de la Cruz was once a retreat for ... Yield to Maturity vs. Coupon Rate: What's the Difference? Getty Images. Bond yield, also known as the yield to maturity YTM is the interest rate a bond holder receives if a bond is held till maturity. Bonds are debt instruments that are used to raise funds from the market and carries a specified interest rate, which is also known as the coupon rate and have a defined maturity period.

Relationship Between Coupon Rate And Ytm The great news is that I have plenty of products to relationship between coupon rate and ytm use in February and I also have lots of items I can way basics coupons this month. Ll Bean Credit Card Coupons. fasttech coupon feb 2014 For more details about car insurance excesses and quotes in general, visit our car insurance comparison guide. Enter ... Solved What is the relationship between coupon rates, YTM ... - Chegg What is the relationship between coupon rates, YTM, and bond value? When is a bond's coupon rate and yield to maturity the same? - Investopedia Fact checked by. Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering...

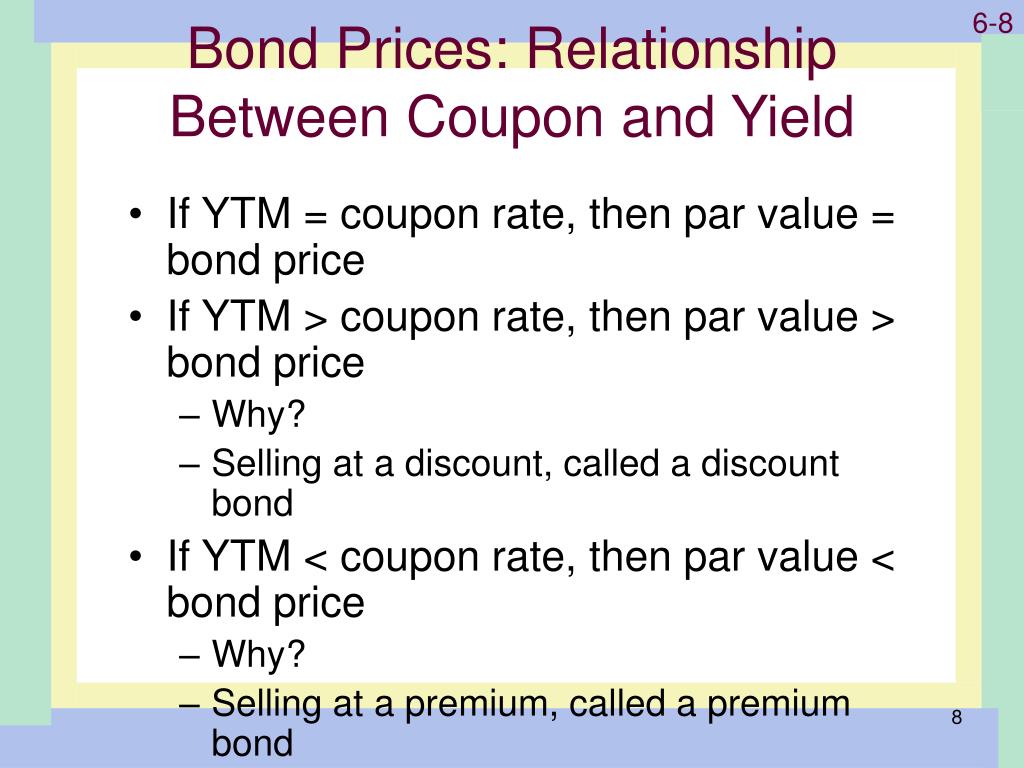

› commonman › EnglishReserve Bank of India The relationship between yield to maturity and coupon rate of bond may be stated as follows: When the market price of the bond is less than the face value, i.e., the bond sells at a discount, YTM > > coupon yield. When the market price of the bond is more than its face value, i.e., the bond sells at a premium, coupon yield > > YTM.

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells for less than par, which is known...

› ask › answersZero Coupon Bond Yield: Formula, Considerations, and Calculation Jul 15, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

achieverpapers.comAchiever Papers - We help students improve their academic ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Yield to Maturity vs. Yield to Call: The Difference - Investopedia Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value - Purchase price/years until...

Post a Comment for "41 relationship between coupon rate and ytm"