40 10 year treasury bond coupon rate

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ... Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

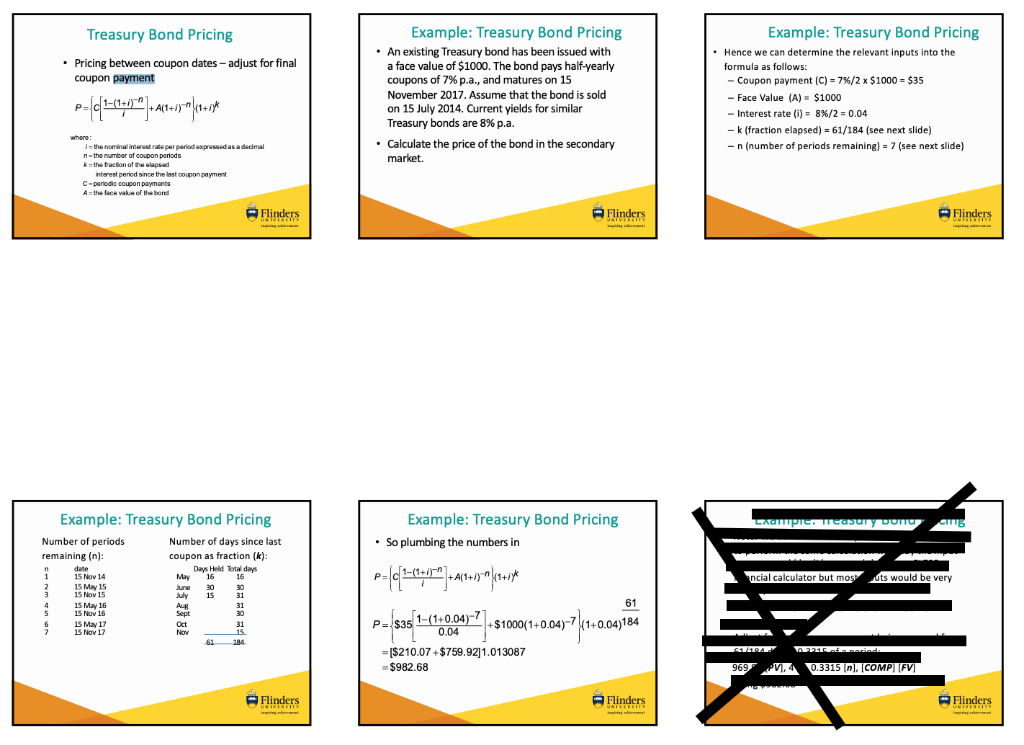

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

10 year treasury bond coupon rate

› articles › investingWhy Is the 10-Year Treasury Yield So Important? - Investopedia The 10-year is used as a proxy for many other important financial matters, such as mortgage rates. This bond also tends to signal investor confidence. The U.S Treasury sells bonds via auction and ... Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

10 year treasury bond coupon rate. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) ycharts.com › indicators › 10_year_treasury_rate10 Year Treasury Rate - YCharts Aug 04, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ... 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates. ... Coupon Rate 2.875%; Maturity May 15, 2032 ...

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) How Is the Interest Rate on a Treasury Bond Determined? - Investopedia As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. 5 That is a lower typical rate than the five years previous. Rates topped 3% briefly a couple of times during 2018.... › rates-bonds › uUS 10 Year Treasury Yield - Investing.com Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive by holding the bond for 10 years. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

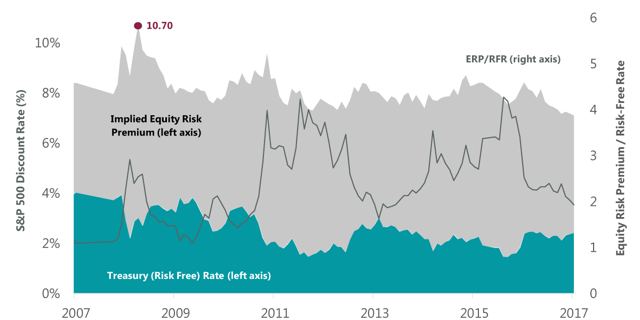

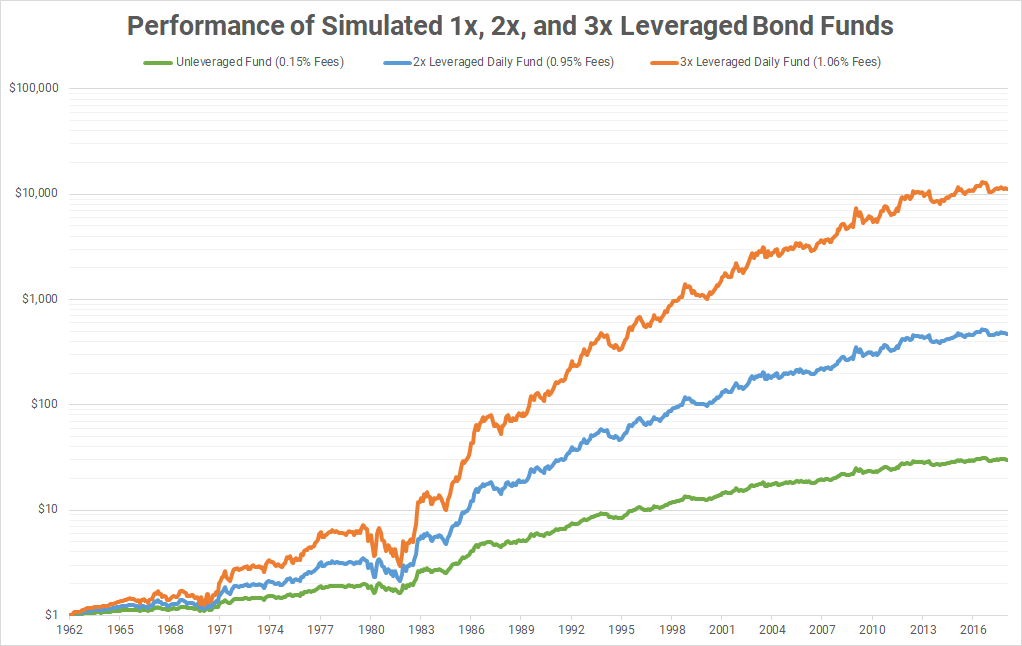

› rates-bonds › 10-2-year-treasury10-2 Year Treasury Yield Spread Bond Yield - Investing.com Jul 05, 2022 · The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity. Stay on top of current and historical data relating to 10-2 Year Treasury Yield Spread ... › 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of August 05, 2022 is 2.83%. › quotes › US10YUS10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Aug 05, 2022 · Coupon 2.875%; Maturity 2032-05-15; Latest On U.S. 10 Year Treasury. ... What this 'play the recovery' strategy says about the hot bond market's future August 4, 2022 CNBC.com. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-08-05 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant ...

› 10-year-treasury-note-330579510-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . ... Muni Bonds 10 Year Yield . 2.27%: 0 ...

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ...

Treasury Coupon Issues | U.S. Department of the Treasury TRC Treasury Yield Curve Spot Rates, End of Month: 2003-2007. TRC Treasury Yield Curve Spot Rates, End of Month: 2008-2012. TRC Treasury Yield Curve Spot Rates, End of Month: 2013-2017. TRC Treasury Yield Curve Spot Rates, End of Month: 2018-Present. TRC Treasury Yield Curve Par Yields, End of Month: 2003-Present.

Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

› articles › investingWhy Is the 10-Year Treasury Yield So Important? - Investopedia The 10-year is used as a proxy for many other important financial matters, such as mortgage rates. This bond also tends to signal investor confidence. The U.S Treasury sells bonds via auction and ...

Post a Comment for "40 10 year treasury bond coupon rate"