40 zero coupon bond benefits

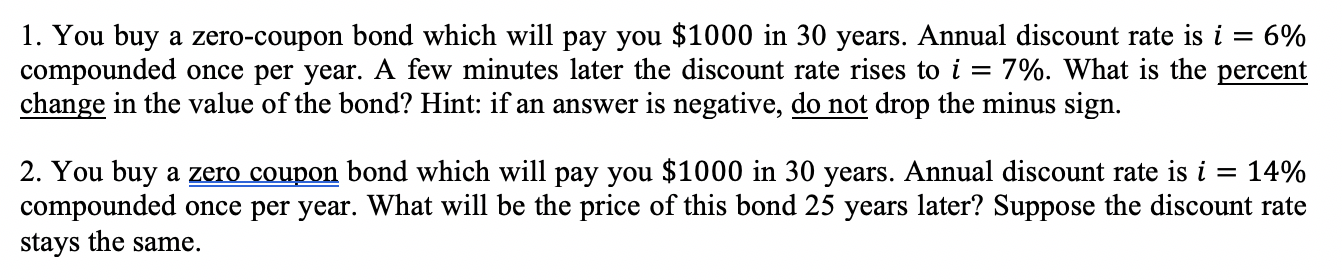

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Ultimate Bond Strength | 3M™ VHB™ Tapes Australia Boost productivity on the assembly floor with the efficiency of tape. 3M™ VHB™ Tape bonds and seals in one step, simplifying the bonding process—even for hard-to-bond sheet metals. The application is quick and simple as compared to riveting and welding, which lack both speed and resolve and are vulnerable to corrosion.

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder ...

Zero coupon bond benefits

zero coupon bond - Definition, Understanding, and ... - ClearTax Calculate Price of Bond using Spot Rates | CFA Level 1 ... Sep 27, 2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds.

Zero coupon bond benefits. Zero-Coupon Bonds - Accounting Hub Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment. The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. How Are Municipal Bonds Taxed? - Investopedia 17-01-2022 · The biggest and most obvious benefit of zero-coupon bonds is that you’re buying the bond at a big discount to its face value. This is also known as the original issue discount or OID. For ... Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available... The ABCs of Zero Coupon Bonds | Benefit & Financial Strategies LLC As with any investment, a zero coupon bond's appropriateness hinges on your individual needs and circumstances. Understanding some of the basic concepts may help you better assess whether they might have a place in your portfolio. 1. The market value of a bond will fluctuate with changes in interest rates. Microsoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount (40). Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market.

Bond Definition - Investopedia 01-07-2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Calculate Price of Bond using Spot Rates | CFA Level 1 27-09-2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

Pros and Cons of Zero-Coupon Bonds | Kiplinger If the certainty of zeros still appeal to you, Winter suggests this strategy: Put some money in zeros that mature in 20 years. Five years from now, buy more zeros that mature 20 years from that...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Easy to Integrate into Financial Plans: Zero-coupon bonds are useful for investors who want a fixed nominal value in the distant future. For instance, people who are planning for their kids' education or marriage can set aside a sum of money right now which will grow and mature into a bigger lump sum at a later stage.

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

What are the advantages and disadvantages of zero-coupon bond? Answer (1 of 8): Advantages of Zero Coupon Bond It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: * No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate to t...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What are the benefits to the issuers of zero-coupon bonds? Answer: The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stoc...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. ... Zero coupon bonds don't offer the same benefits. Those bonds are issued at a deep discount and repay the par value at maturity. There is no coupon payment, hence the name.

Zero Coupon Bonds - David Lerner Associates A husband and wife can each gift $14,000 for a total of $28,000, and this can continue to grow with the tax benefits of zero coupon municipal bonds. "Kiddie tax": A series of changes to the tax rules, starting in 1986, means that minors' accounts generating more than $2,000 in annual income for children under the age of 19 are taxed at the ...

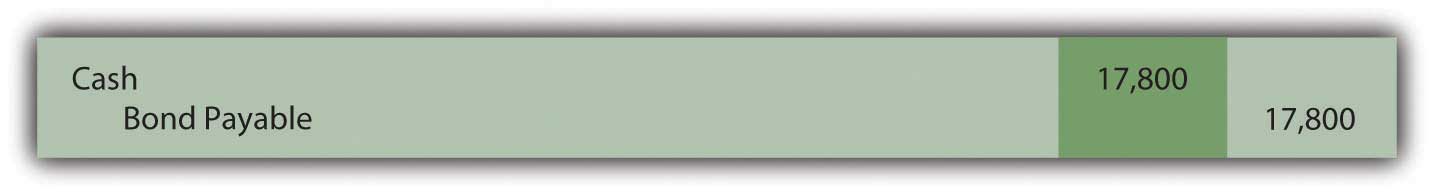

14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term “compounding.”

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Bond Definition - Investopedia Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

Zero-Coupon Bond - The Investors Book A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

14.3 Accounting for Zero-Coupon Bonds – Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made.

/five_thousand_dollar_series_i_savings_bond-56a091263df78cafdaa2cb4c.gif)

Post a Comment for "40 zero coupon bond benefits"